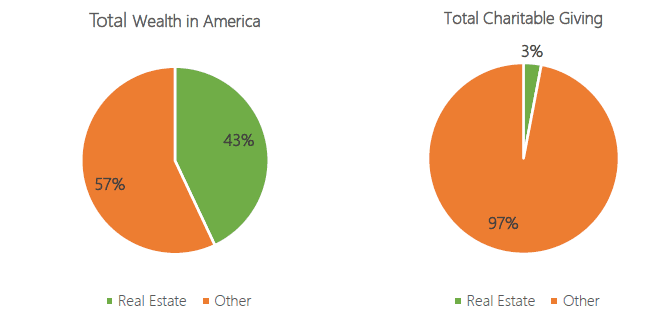

Real estate has been an excellent long-term investment for many. It is the largest asset class in America, comprising 43% of America’s total wealth – yet, less than 3% of total charitable giving comes from gifts of real estate.

Why such a discrepancy? It may be that charitably-minded persons simply do not realize the powerful asset of real estate at their disposal and the impact that it can make helping fund their favorite causes.

Is a Real Estate Donation Right for You?

Is a Real Estate Donation Right for You?

The owner of the real estate should consider the following questions:

- Have they been enjoying the benefits of 1031 exchanges?

- Are they not currently using this property?

- Does the property fail to meet their investment objectives (a rental property with ongoing vacancy) or social objectives (a family vacation home that is no longer used as frequently)?

- Would a large capital gains tax be due if they sold this property?

If the answer is “yes” to any combination of these questions, the property may be a good candidate for gifting.

Donating a Property through a Donor Advised Fund

Donor advised funds (DAFs) are charitable giving vehicles that are established by a sponsoring public charity, which make grants to other charitable organizations based upon recommendations from the donor. By donating appreciated real estate to a donor advised fund, the owner can earn generous tax benefits, support their favorite causes, and free up time for other pursuits.

American Endowment Foundation (AEF) is a public charity that enables donors to create a donor advised fund. AEF administers the fund on behalf of the donor. The donor can then recommend grants to qualified nonprofit organizations on their own timetable. The donor’s financial advisor can remain involved in managing the investment dollars that reside in the DAF account.

How It Works

Any gift of real estate is subject to the review and approval of the AEF Gift Acceptance Committee and requires a minimum appraised value of $500,000. AEF strongly prefers that any gift involving real estate is an interest in an entity that directly or indirectly owns the real estate (e.g. stock in a corporation or interests in a partnership, trust, limited liability company or other entity) rather than the property itself. At AEF, after a donor establishes a donor advised fund with AEF, the donor irrevocably transfers title of no more than 90% of the entity to the fund. The donor may be eligible for an immediate federal tax deduction equal to the Fair Market Value (FMV) of the entity donated, up to 30% of the adjusted gross income (AGI). If the FMV of the donation is greater than 30% of AGI, the excess can be carried forward for five years.

This compares very favorably to similar donations made to a private foundation, which are generally deductible at cost basis. After ownership of the entity has been transferred to the fund, AEF will work with the donor and their financial advisor to sell the property. The donor will then be responsible for the dissolution of the entity (if not sold with the real estate) with their legal and tax advisors in accordance with the Secretary of State where the entity is domiciled. Once this process has been completed, the cash proceeds will be available for the donor to donate through their DAF.

In some cases, AEF may partner with Realty Gift Fund, a 501(c)3 tax exempt entity that:

- Directly accepts gifts of real estate

- Triggers the tax benefits for donors

- Isolates the title & financial risks during the acceptance, holding, & marketing periods

- Provides cash grants from the net proceeds of the real estate sale to fund the AEF DAF

Realty Gift Fund provides donors and their advisors an experienced and qualified nonprofit for real estate donations and uses its expertise and resources to manage the complete donation cycle, including IRS documentation.

By choosing this device, the donor utilizes a tax-smart tool to support the good causes important to them and implement donations through their AEF Donor Advised Fund on a timetable that fits their schedule and interests.

Contact us or call at 1-888-966-8170 with any further questions.

Is a Real Estate Donation Right for You?

Is a Real Estate Donation Right for You?