By Christopher Clarkson, Director – Wealth Strategies Group, Bernstein Private Wealth Management, Guest Columnist

Are your clients feeling generous, but not quite ready to part with their wealth? They could consider bequeathing assets to a donor advised fund instead. MacKenzie Scott made big waves last year when she donated over $8.5 billion in three rounds of charitable giving, setting the record for the largest distribution by a living individual to working charities. But not all donors who wish to support cherished charitable organizations are ready to give away assets today.

Fortunately, there is a simple way for your clients to give without impacting their day-to-day finances. A bequest is a way to leave money to charity through a will or trust after death. It costs nothing now, but it can support a charitable organization’s future while leaving a lasting legacy. In fact, donors often choose to honor friends or family members by creating a memorial fund in their name.

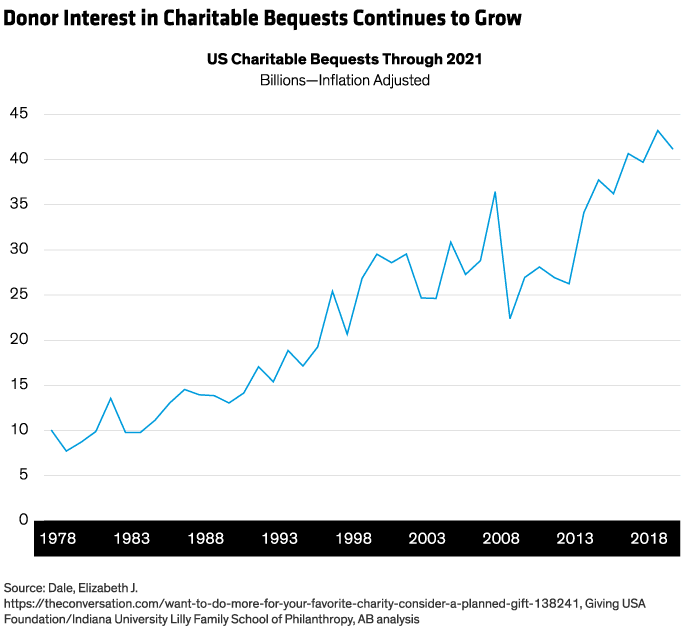

Not surprisingly, bequests are the most popular type of planned gift. According to the Giving USA 2021 report, donors bequeathed an eye-popping $41.91 billion to charity in 2020. That represents 9% of all charitable gifts made in 2020—and more than double the amount given by large corporations.[i] What’s more, last year’s figure is just the latest in a long upward march, demonstrating the enduring popularity of this approach.

Bequests Are Easy

There are several reasons donors are attracted to this planned giving strategy. First, making a bequest is easy. Donors can simply include a bequest provision when creating or revising their will or revocable trust. They can even add the provision to an existing will through a codicil. American Endowment Foundation can provide sample language, but make sure your clients consult their estate attorneys for assistance in formalizing their intentions.

Bequests Are Flexible

A general bequest is the most common type. It typically calls for a dollar amount to be paid to an organization from the estate’s general assets. But donors have great flexibility in terms of structure, including the ones below:

- A specific bequest can be used to give a specified property or asset. Be careful though—if the specified property is no longer owned at death, the intended beneficiary may end up with nothing.

- A demonstrative bequest can be used to make a specific distribution from a named source or account.

- A residuary bequest gives all or a portion of the estate that remains after the other bequests, debts, and taxes have been paid.

Here again, an estate planning professional can help your clients incorporate the type of bequest that works best for them.

Bequests Can Go to Donor Advised Funds, Too

If donors don’t know in advance which charitable organizations they’d like to benefit, they can leave assets to a donor advised fund instead. It’s generally a good idea for your clients to establish this legacy fund during their lifetime, even if they don’t intend to fund it until their death.

Don’t Forget About Retirement Accounts and Life Insurance

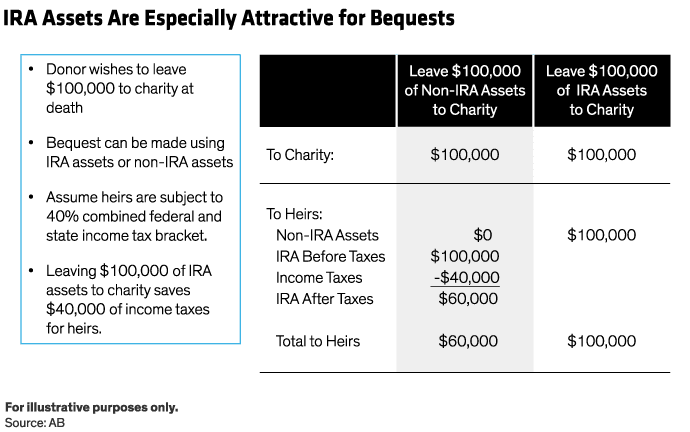

IRA or qualified retirement plan assets can be very attractive to leave to charity. Consider that when IRA assets are left to family members, any distributions will be subject to ordinary income taxes, and the IRA assets may be subject to estate taxes, too.

Since retirement assets left to charity won’t be subject to the same tax burden, it often makes sense to leave such assets to charity and non-IRA assets to family members who net more after taxes. In this case, donors should simply name the charity on their IRA Designation of Beneficiary form. Display

Alternatively, those who find they no longer need life insurance proceeds to replace their income or pay estate taxes, could consider naming their favorite charity or donor advised fund as a beneficiary on a life insurance policy instead. This can be a great way to support the mission for decades to come.

What About Taxes?

A bequest passing to charity upon death qualifies for the unlimited estate tax charitable deduction. However, bequests usually don’t provide a charitable income tax deduction, although there may be an exception if the governing will or trust document includes specific instructions. Here, the document must stipulate that if the will or trust makes a charitable bequest, then that bequest should be made first with income, including income in respect of a decedent (IRD).[i]

This differs from the tax treatment of lifetime gifts which do qualify for a charitable income tax deduction, depending on your client’s tax situation. As a Financial Advisor, you can help your clients by walking through the different options for giving now or later and recommending a course of action that’s beneficial from a tax perspective while maintaining their financial security.

The views expressed herein do not constitute, and should not be considered to be, legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.

At American Endowment Foundation, we look forward to helping donors and advisors determine the best strategies for their charitable giving. Please contact us or call at 1-888-966-8170 with any questions.